News

Viele Biotech-Unternehmen habe grosse Mühe mit der Zulassung ihrer Produkte. (Illustration: Karsten Petrat)

Was die kränkelnde Schweizer Biotech-Branche für Investoren bedeutet

Werner Grundlehner, Neue Zürcher Zeitung, 11.11.2019

Das Feld der kotierten Schweizer Biotech-Firmen bietet das Bild eines grossen Krankenlagers. So sollen sich interessierte Investoren verhalten.

Nur 13.8% der Entwicklungsprojekte in der Pharmaindustrie schaffen es gemäss einer Studie von der Phase I bis zur Zulassung (Bild: Andrew Brookes/Deepol by Plainpicture)

Diese Schweizer Biotechs könnten zünden

Rupen Boyadjian, Finanz und Wirtschaft, 25.09.2019

Drei bis fünf Aktien kleiner Pharmaunternehmen bieten zusammen bis Ende 2020 gutes Kurssteigerungspotenzial - selbst wenn eine abstürzt.

Jean-Paul Clozel will es nach dem Verkauf von Actelion mit Idorsia nochmals versuchen. (Bild: Arnd Wiegmann / Reuters)

Die Biotech-Branche jubiliert - die kotierten Firmen leiden

Werner Grundlehner, Neue Zürcher Zeitung, 18.05.2019

Am Branchentag feiert die Schweizer Biotech-Branche ihre Erfolge und die rosige Zukunft. Wirft man aber einen Blick auf die kotierten Unternehmen, stellt sich grosse Ernüchterung ein. Woher kommt die Diskrepanz?

Börse Frankfurt (Bild: Mark Potter / Reuters)

Und was macht der Aktien-Analytiker in Zukunft?

Werner Grundlehner, Neue Zürcher Zeitung, 31.05.2018

Einführung von Mifid II - und wahrscheinlich auch mit dem neuen Fidleg - kommt es in den Research-Abteilungen zu grossen Umwälzungen. Wie die Aktienanalyse mit dem Ende der Quersubventionierung umgeht.

SWITZERLAND IS BREAKING NEW GROUND

The big names in Swiss industry aren't the only ones investing in R&D. In the shadow of the giants, less prominent companies are leaving the beaten track and performing well on the stock exchange.

Wie Anleger erfolgreich in Biotech investieren

Michael Griesdorf, Finanz und Wirtschaft, 29.05.2017

Aktien von Unternehmen, die noch kein Medikament auf dem Markt haben, sind hochriskant. Mit dem richtigen Vorgehen lassen sich die Risiken aber minimieren.

Actelion ist eine Erfolgsgeschichte der Biotech-Industrie. Die Gründer kauften dem Pharmakonzern Roche 1996 die Idee für eine neue Wirkstoffklasse ab und entwickelten darauf basierend als Erste ein orales Medikament gegen die seltene Lungenkrankheit PAH. Heute erzielt Actelion einen Umsatz von 2,4 Mrd. $ und wurde soeben für 30 Mrd. $ vom US-Gesundheitskonzern Johnson & Johnson übernommen. Wer seit dem Börsengang zur Jahrtausendwende dabei war, hat einen Gewinn von über 1000% der Anfangsinvestition erzielt. Das lässt so manchen Anleger neidisch werden. Was dabei schnell vergessen geht: Die Gründungsinvestoren haben immense Risiken auf sich genommen.

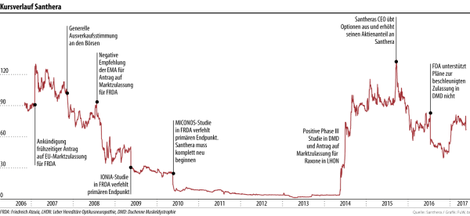

Biotech-Aktien sind schwankungsanfällig

Michael Griesdorf, Finanz und Wirtschaft, 29.05.2017

Der Kursverlauf ist meist von einzelnen grossen Ereignissen geprägt. Denn Erfolg und Misserfolg der Unternehmen liegen nahe beieinander.

Am Kursverlauf von Santhera ist gut zu sehen: Erfolg und Misserfolg liegen bei Biotech-Unternehmen im Entwicklungsstadium nahe beieinander. Santhera ist heute auf neuromuskuläre und mitochondriale Krankheiten fokussiert. Höhen und Tiefen wechselten sich seit dem Börsengang 2006 (Emissionspreis 90 Fr.) ab. Der Kurs sackte auf 1.34 Fr. ab und notiert derzeit rund 65 Fr.

Newron’s Journey to Launch the First Parkinson’s Drug in 11 Years

INTERVIEW 20.04.2017

Philip talked to Stefan Weber, CEO of Newron Pharmaceuticals, in our first meetup in Munich last week. His company has launched a new drug that could offer many more benefits than current medications to patients with Parkinson’s. Stefan discussed how failure can be an important part of success and what being European means in biotech.

Source: Labiotech.eu/Clara Rodríquez Fernández

Watch the video to get all the details and learn about Newron’s plans after Xadago

valuationLAB AG is proud to announce a research distribution agreement with Bloomberg. Our public Valuation Reports are now available on Bloomberg Terminal®.

Bloomberg Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world.

For more information, go to bloomberg.com/professional.

valuationLAB research now available on Thomson Reuters

valuationLAB AG is proud to announce a research distribution agreement with Thomson Reuters, the world's leading source of intelligent information for businesses and professionals. Our public Valuation Reports are now available on the platforms of Thomson Reuters (e.g. TR Eikon, Thomson ONE) and Thomson Reuters Third Party Distribution Partners (e.g. FactSet, NASDAQ, Acquire Media, AlphaSense, Track Data). Thomson Reuters’ premium distribution channel is capable of reaching a broad clientele of 19,000 institutional investors and corporations worldwide.

Thomson Reuters - The Answer Company

Thomson Reuters is the world's leading source of intelligent information for businesses and professionals. We combine industry expertise with innovative technology to deliver critical information to leading decision makers in the financial and risk, legal, tax and accounting, intellectual property and science and media markets, powered by the world's most trusted news organization. Thomson Reuters shares are listed on the Toronto and New York Stock Exchanges.

For more information, go to financial.thomsonreuters.com.

Santhera named "Company of the Week" in the Swiss newspaper NZZ am Sonntag. Last week Santhera's share price jumped 22.6% on the back of the EU approval of Raxone for treating LHON (a rare genetic disease that leads to sudden blindness), the CEO raising his stake in the company to 1.47% from 0.77% by exercising stock options, and valuationLAB raising the risk-adjusted NPV of Santhera to CHF 188 per share on higher than expected pricing of Raxone (see Santhera Valuation Report "Going it a-LHON" below).

Recent publication of Santhera Valuation Report by valuationLAB triggers a sharp rise in Santhera's share price and trading volume. Providing corporate research is a common and legitimate way for small cap companies to regain investor visibility. CEO Thomas Meier views our risk-adjusted sum-of-parts NPV as rather conservative. Last year's publication of our Newron Valuation Report led to a doubling of their share price.

Three key steps to unlock value: 1) Understand; 2) Quantify; 3) Share. Dramatic decline in broker research coverage a serious bottleneck - research boutiques filling the gap. New product wave emerging in Swiss biotechnology with new success stories. Maturing private biotech pipeline but funding of early stage products remains a concern.

Swiss Biotech Report 2013

valuationLAB participates in the expert panel "How to secure funding for basic research in Switzerland" (pages 14-18)

(click on picture to download report)